randolphritz12

About randolphritz12

Investing in Gold: A Timeless Strategy for Wealth Preservation

In an ever-fluctuating financial landscape, where stock markets can soar one day and plummet the next, the allure of gold as a reliable investment continues to shine brightly. For centuries, gold has been revered not just as a precious metal but as a safe haven for preserving wealth. As more investors seek stability amidst economic uncertainty, the question arises: is now the right time to buy gold for investment?

The Historical Significance of Gold

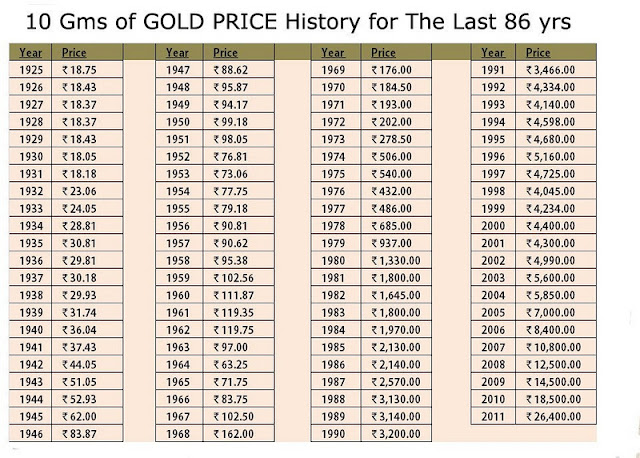

Gold’s intrinsic value has been recognized since ancient civilizations, where it was used for currency, jewelry, and even as a symbol of power. Throughout history, gold has maintained its worth, often serving as a hedge against inflation and currency devaluation. In times of crisis, such as wars, economic downturns, or political instability, gold tends to retain its value, making it an attractive option for those looking to safeguard their assets.

Current Market Trends

As of late 2023, gold prices have shown significant volatility, influenced by various global economic factors. The ongoing geopolitical tensions, supply chain disruptions, and rising inflation rates have led many investors to reconsider their portfolios. According to recent reports, gold prices have surged to levels not seen in several years, prompting both seasoned investors and newcomers to explore gold as a viable investment option.

Why Invest in Gold?

- Inflation Hedge: One of the primary reasons investors flock to gold is its ability to act as a hedge against inflation. When the cost of living rises, the purchasing power of fiat currencies diminishes. Gold, on the other hand, often appreciates in value during inflationary periods, making it a sound choice for preserving wealth.

- Diversification: Gold provides an excellent opportunity for diversification. By including gold in an investment portfolio, investors can reduce overall risk. Historically, gold has had a low correlation with other asset classes, such as stocks and bonds. This means that when equity markets decline, gold prices may rise, helping to balance the portfolio.

- Safe Haven: In times of economic uncertainty, investors typically flock to gold. This ”safe haven” status is well-documented, as gold tends to perform well during market downturns. As global tensions rise and economic forecasts become murky, gold’s reputation as a stable asset continues to attract investors.

- Liquidity: Gold is one of the most liquid assets available. It can be easily bought or sold in various forms, including coins, bars, and exchange-traded funds (ETFs). This liquidity makes it a convenient option for investors who may need to access their funds quickly.

- Global Demand: Gold is not only valued in Western markets but also has significant demand in emerging economies, particularly in Asia. Countries like India and China have a long-standing cultural affinity for gold, driving demand and supporting prices.

How to Invest in Gold

Investing in gold can be done through various avenues, each with its pros and cons:

- Physical Gold: Buying physical gold, such as coins or bullion, allows investors to hold the asset directly. However, it comes with storage and insurance costs, and investors must ensure they purchase from reputable dealers to avoid counterfeit products.

- Gold ETFs: Exchange-traded funds that track the price of gold provide a convenient way to invest without the hassles of storage. If you have any questions concerning where and how you can use buynetgold, you can contact us at our site. These funds allow investors to buy shares that represent a specific amount of gold, making it easier to trade on stock exchanges.

- Gold Mining Stocks: Investing in companies that mine gold can offer exposure to the gold market. However, these stocks can be influenced by factors beyond gold prices, such as operational challenges and management decisions.

- Gold Futures and Options: For more experienced investors, trading gold futures and options can provide opportunities for profit based on price movements. However, these instruments carry higher risks and require a solid understanding of the market.

Factors to Consider Before Investing

Before diving into gold investment, it’s essential to consider several factors:

- Market Conditions: Keep an eye on economic indicators, geopolitical events, and market trends that can influence gold prices. Understanding these factors can help investors make informed decisions about when to buy or sell.

- Investment Goals: Clearly define your investment objectives. Are you looking for long-term wealth preservation, short-term gains, or diversification? Your goals will dictate your approach to investing in gold.

- Risk Tolerance: Assess your risk tolerance before investing. While gold is generally considered a safe investment, its price can still fluctuate. It’s crucial to determine how much risk you are willing to take on in your overall portfolio.

- Time Horizon: Consider your investment time frame. Gold can be a great long-term investment, but short-term price volatility may not suit all investors.

Conclusion

As we navigate the complexities of the modern financial world, gold remains a steadfast option for those looking to secure their wealth. Its historical significance, ability to hedge against inflation, and status as a safe haven make it a compelling investment choice. Whether you are a seasoned investor or just starting, understanding the nuances of gold investment can help you make informed decisions that align with your financial goals.

In conclusion, as the global economy continues to evolve, the timeless appeal of gold as an investment is unlikely to diminish. With careful consideration and strategic planning, buying gold can be a prudent step toward achieving financial stability and preserving wealth for future generations.

No listing found.